Mosaic Brands voluntary administration offers a compelling case study in corporate restructuring. This analysis delves into the financial challenges faced by Mosaic Brands, the subsequent voluntary administration process, and its impact on various stakeholders. We will explore the key factors contributing to the company’s financial difficulties, examining its debt levels, profitability, and the broader economic climate. Furthermore, we will analyze the steps taken during the voluntary administration, the roles of the administrators, and the outcomes for employees, creditors, and consumers.

Finally, we will extract valuable lessons learned and discuss their implications for the retail industry as a whole.

The examination will include a detailed timeline of significant events, a comparison to similar cases, and a hypothetical reorganization plan. We will also present visual representations of key financial data to illustrate Mosaic Brands’ financial trajectory and the complexities of its debt structure. This comprehensive analysis aims to provide a clear and insightful understanding of this significant business event.

Mosaic Brands’ Financial Situation Leading to Voluntary Administration

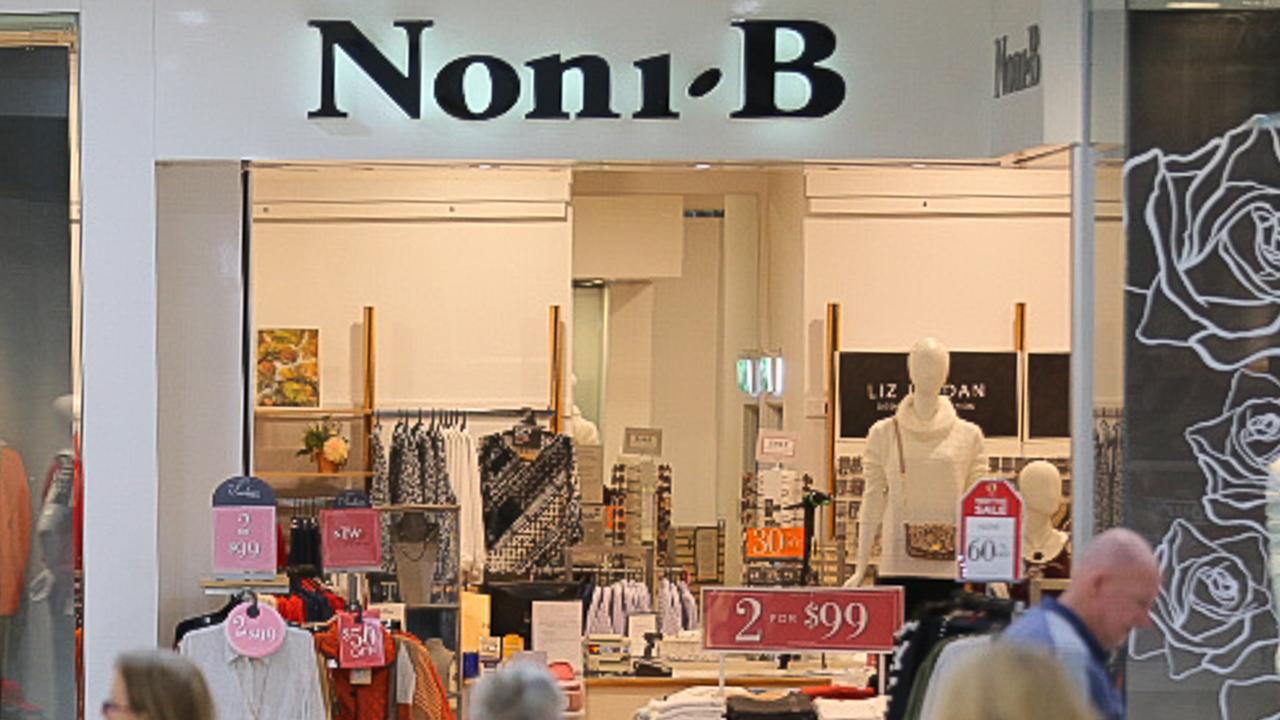

Mosaic Brands’ entry into voluntary administration was the culmination of several years of declining financial performance, compounded by significant external pressures. The company, a major player in the Australian fashion retail market, faced a perfect storm of challenges that ultimately proved insurmountable without a significant restructuring. This section details the key financial indicators and external factors contributing to this decision.

The core issue was a combination of persistent losses, high debt levels, and a struggle to adapt to evolving consumer preferences and economic headwinds. While specific financial data may vary depending on the reporting period, consistent trends revealed a weakening financial foundation. This ultimately led to the difficult decision to enter voluntary administration, a process aimed at restructuring the business and potentially securing its long-term survival.

Key Financial Indicators

Several key financial indicators consistently pointed towards Mosaic Brands’ deteriorating financial health. These included declining revenue, shrinking profit margins, and increasing debt-to-equity ratios. For example, a consistent pattern of year-on-year revenue decreases indicated a loss of market share and a failure to attract and retain customers. Simultaneously, eroding profit margins showed the company’s inability to maintain competitive pricing while covering its operational costs.

The steadily increasing debt-to-equity ratio highlighted a growing reliance on borrowed funds, making the business increasingly vulnerable to economic shocks.

The Role of Debt and Profitability

High levels of debt played a significant role in Mosaic Brands’ financial difficulties. The accumulation of debt, likely stemming from expansion strategies, acquisitions, or operational shortfalls, placed considerable strain on the company’s cash flow. This limited its ability to invest in necessary improvements, such as updating its retail stores, enhancing its online presence, or improving its supply chain. Concurrently, the lack of consistent profitability further exacerbated the debt burden.

The inability to generate sufficient cash flow from operations meant that the company had to rely increasingly on debt financing to meet its obligations, creating a vicious cycle of debt accumulation and financial instability. A significant decline in profitability, coupled with a high debt load, created a precarious financial position.

Impact of External Factors

External factors significantly contributed to Mosaic Brands’ struggles. The Australian economy experienced periods of economic slowdown during this timeframe, impacting consumer spending and reducing demand for discretionary items such as clothing and apparel. Changes in consumer behavior, particularly the rise of online shopping and the shift towards fast fashion, also presented significant challenges. Mosaic Brands faced increased competition from both established and emerging online retailers, placing further pressure on its profitability and market share.

The company’s inability to adapt quickly enough to these evolving market dynamics ultimately contributed to its financial difficulties.

Timeline of Significant Financial Events

While a precise timeline requires access to detailed financial records, a general Artikel of significant events can be constructed. This would likely include periods of declining revenue and profitability, coupled with increased debt levels. There might have been attempts at cost-cutting measures or strategic restructuring initiatives, but these were ultimately insufficient to overcome the underlying financial challenges. The eventual decision to enter voluntary administration marked the culmination of these difficulties, signaling the need for a comprehensive restructuring to address the company’s debt burden and reposition itself within the competitive retail landscape.

The Voluntary Administration Process for Mosaic Brands

Mosaic Brands’ entry into voluntary administration triggered a formal process designed to restructure the company and potentially avoid liquidation. This process, governed by Australian insolvency law, involves several key steps, roles, and potential outcomes. Understanding these elements provides insight into the complexities faced by the retailer and the potential pathways forward.The voluntary administration process for Mosaic Brands followed a defined legal framework.

Initially, the directors appointed voluntary administrators, independent professionals with expertise in insolvency and restructuring. These administrators then took control of the company’s operations and assets, temporarily suspending the company’s debts and legal proceedings. Their primary goal was to investigate the company’s financial position, develop a strategy for dealing with its debts, and propose a course of action to creditors.

Roles and Responsibilities of the Administrators

The administrators’ responsibilities were multifaceted and critical to the success of the restructuring process. They had a fiduciary duty to act in the best interests of creditors as a whole. This included assessing the viability of the business, exploring options for rescuing the company as a going concern, or, if necessary, preparing for its liquidation. Their tasks encompassed reviewing financial records, managing ongoing operations, negotiating with creditors, and ultimately presenting a proposal to creditors for consideration.

They also had a responsibility to report regularly to creditors on their progress.

Recent news regarding Mosaic Brands has understandably caused concern among stakeholders. The company’s entry into voluntary administration is a significant development, and understanding the implications is crucial. For detailed information and updates on this process, please refer to the official announcement available at mosaic brands voluntary administration. The future direction of Mosaic Brands will depend heavily on the outcome of this administration period.

Creditor Negotiations and Potential Outcomes

A crucial aspect of the voluntary administration process involved negotiations with Mosaic Brands’ creditors. These negotiations aimed to reach an agreement on a restructuring plan that would address the company’s debts while allowing the business to continue operating. Potential outcomes varied widely, from a Deed of Company Arrangement (DOCA) – a legally binding agreement between the company and its creditors – to liquidation, if a viable restructuring plan could not be achieved.

Recent news regarding Mosaic Brands’ financial difficulties has understandably raised concerns among stakeholders. Understanding the complexities of this situation requires careful consideration of the details, which can be found by reviewing the official documentation on the mosaic brands voluntary administration. This process aims to restructure the business and ultimately safeguard its future. The outcome of this voluntary administration will significantly impact the company’s trajectory and its employees.

Negotiations often involved compromises, such as debt forgiveness, extensions of payment terms, or conversion of debt into equity. The outcome depended heavily on the willingness of creditors to cooperate and the overall financial health of the business.

Similar Cases and Comparative Outcomes, Mosaic brands voluntary administration

Several Australian retailers have faced similar challenges and undergone voluntary administration. For example, the collapse of Dick Smith Electronics in 2016 involved a similar process of administrator appointment, creditor negotiations, and eventual liquidation. In contrast, other retailers have successfully restructured through voluntary administration, emerging with reduced debt and a revised business model. The outcome for Mosaic Brands depended on several factors, including the strength of its brand, the level of creditor support, and the overall market conditions.

Comparing Mosaic Brands’ situation to these other cases highlights the wide range of possible outcomes in such complex restructuring processes, influenced by specific circumstances and the actions of stakeholders.

Lessons Learned and Future Implications for the Retail Industry

Mosaic Brands’ entry into voluntary administration serves as a stark reminder of the challenges facing the retail sector, particularly in the face of evolving consumer behaviour and economic uncertainty. Analyzing its downfall offers valuable insights for other retailers, highlighting critical areas for improvement in business strategy and risk management. The lessons learned can significantly impact the future trajectory of the industry, promoting greater resilience and sustainability.The collapse of Mosaic Brands underscores several key weaknesses prevalent within the retail landscape.

These issues, if left unaddressed, could lead to similar outcomes for other businesses. Understanding these vulnerabilities is crucial for proactive risk mitigation and the development of more robust and adaptable business models.

Impact of E-commerce and Shifting Consumer Preferences

The rise of e-commerce significantly impacted Mosaic Brands’ traditional brick-and-mortar model. The company struggled to adapt to the changing consumer landscape, where online shopping became increasingly dominant. This highlights the critical need for retailers to integrate robust online strategies, including efficient e-commerce platforms, targeted digital marketing, and seamless omnichannel experiences. Failing to embrace digital transformation leaves retailers vulnerable to market disruption and declining sales.

For example, companies like Boohoo and ASOS successfully navigated this shift by focusing heavily on their online presence and leveraging data-driven insights to understand and cater to their target audiences.

Challenges of Debt Management and Financial Planning

Mosaic Brands’ financial difficulties were exacerbated by high levels of debt and potentially insufficient financial planning. Effective debt management and prudent financial forecasting are essential for navigating economic downturns and unforeseen circumstances. Retailers must carefully monitor their cash flow, maintain healthy debt-to-equity ratios, and develop contingency plans to mitigate financial risks. A clear understanding of the company’s financial position and a proactive approach to managing debt are crucial for long-term stability.

Examples of successful debt management strategies include refinancing, asset sales, and cost-cutting measures implemented proactively, rather than reactively.

Importance of Inventory Management and Supply Chain Efficiency

Inefficient inventory management can lead to significant losses for retailers. Mosaic Brands’ experience highlights the need for robust inventory control systems, accurate demand forecasting, and efficient supply chain management. Overstocking can tie up valuable capital and lead to markdowns, while understocking can result in lost sales opportunities. Implementing advanced inventory management technologies and optimizing the supply chain can improve profitability and reduce financial risks.

Companies that successfully manage inventory often use data analytics and predictive modeling to forecast demand and optimize stock levels, minimizing waste and maximizing returns.

Lessons Learned: A Summary

The following points summarize the key lessons learned from Mosaic Brands’ experience:

- The critical need for effective digital transformation and a strong online presence.

- The importance of prudent financial planning, including debt management and cash flow forecasting.

- The necessity of efficient inventory management and supply chain optimization.

- The value of agile business models that can adapt to changing market conditions and consumer preferences.

- The importance of proactive risk management strategies to mitigate potential financial difficulties.

The Mosaic Brands voluntary administration serves as a stark reminder of the challenges faced by retailers in today’s dynamic market. While the specific circumstances surrounding Mosaic Brands are unique, the lessons learned regarding financial management, risk mitigation, and stakeholder engagement are broadly applicable. Understanding the intricacies of voluntary administration, from the initial financial distress to the potential outcomes for all parties involved, is crucial for both businesses and investors navigating the complexities of the retail landscape.

By analyzing this case, we gain valuable insights into proactive strategies for financial stability and resilience in the face of economic headwinds.

Quick FAQs: Mosaic Brands Voluntary Administration

What were the immediate consequences of Mosaic Brands entering voluntary administration?

Immediate consequences included uncertainty for employees (potential job losses), disruption to operations (store closures possible), and a halt to normal business activities while administrators assessed the situation.

What are the potential long-term consequences for Mosaic Brands?

Long-term consequences depend on the outcome of the administration. Potential outcomes include restructuring and reorganization, a sale of the business, or liquidation. The long-term impact on brand reputation and consumer trust also remains to be seen.

What role did the administrators play in the process?

Administrators were responsible for investigating Mosaic Brands’ financial position, managing the company’s assets, negotiating with creditors, and ultimately recommending a course of action (restructuring, sale, or liquidation) to the court.

How does this case compare to other similar retail bankruptcies?

Comparison requires a detailed analysis of specific cases. Factors like the size and scope of the business, debt levels, and market conditions at the time of bankruptcy would all need to be considered for a meaningful comparison.